Like it or not, it's that time of year again: tax season, also known as a cyber criminal's holy grail. There's a reason why tax season is one of the busiest periods for cyber crime - it's an opportunity for cirminals to steal tonnes of personal information and critical data.

If you're filing your taxes online this year, here are some things you can do to protect yourself from identity and financial theft.

76 % of Canadians are concerned about identity theft.Note i

Protect your identity

Your tax data is a gold mine for cyber criminals. Your taxes contain all of the information they need to steal your identity - like your social insurance number (SIN), your record of employment, your family status and even your bank account information.

You can protect yourself by:

-

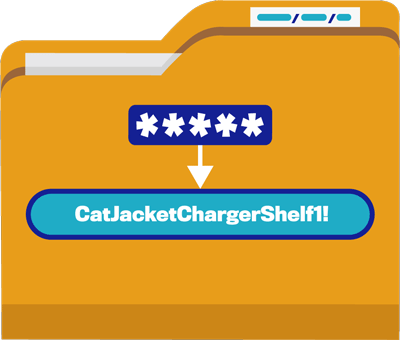

creating a strong, unique passphrase or password for each of your tax accounts

creating a strong, unique passphrase or password for each of your tax accounts -

enabling multi-factor authentication (MFA) whenever it's available

enabling multi-factor authentication (MFA) whenever it's available

29% of Canadians still use the default password on their home Wi-Fi networks. Note i

File your taxes on a secure network

Public Wi-Fi connections that don't require passwords, like your local library or coffee shop, are risky. You should never access personal accounts or send sensitive information, like your taxes, while using unsecured networks. Save these tasks for when you have a secure connection. If you need to use a public Wi-Fi network, make sure you're using a VPN so that you can protect your private information.

You can file your taxes safely by:

-

only filing on a secure network, like your home Wi-Fi

only filing on a secure network, like your home Wi-Fi -

using a VPN to protect sensitive information

using a VPN to protect sensitive information -

enabling your firewall

enabling your firewall -

not accessing sensitive info on public Wi-Fi unless using a VPN

not accessing sensitive info on public Wi-Fi unless using a VPN -

updating your home network's username and passwords from the default settings

updating your home network's username and passwords from the default settings

3 in 10 Canadians are concerned about phishing scams.Note i

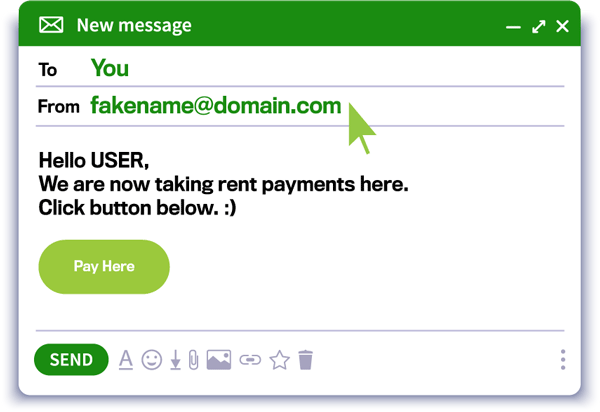

Be on the lookout for phishing attacks

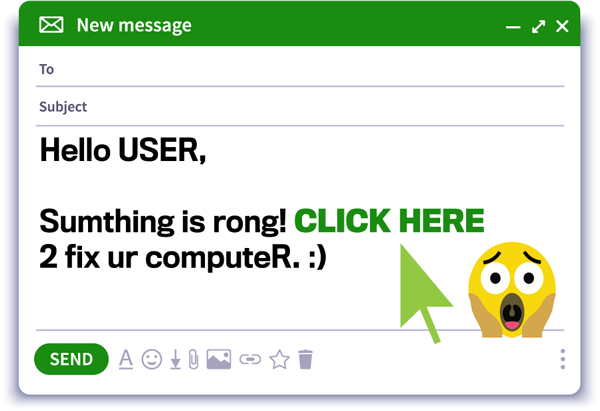

Cyber criminals will often impersonate legitimate organizations or individuals to steal your information. These phishing attempts are harder to spot during tax season when you might think that the Canada Revenue Agency (CRA) is contacting you.

You can identify phishing scams by looking out for some common red flags:

-

email or texts that have spelling or grammar mistakes

email or texts that have spelling or grammar mistakes -

poor formatting, or blurry logos and images

poor formatting, or blurry logos and images -

suspicious links or attachments

suspicious links or attachments -

email addresses that are suspicious or don't match the organization they claim to be from

email addresses that are suspicious or don't match the organization they claim to be from

Not sure if it's really the CRA ? Learn what to expect if the CRA contacts you by visiting their official website.

45% of Canadians set their devices to update automatically.Note i

Update your devices as a defence

Software updates aren't just for new features. They also come with critical patches, bug fixes and security updates. Ensuring your devices are up to date could help you fight off a cyber attack.

You can secure your software by:

-

setting your devices to run updates automatically

setting your devices to run updates automatically -

regularly updating your anti-virus software

regularly updating your anti-virus software -

updating your software as soon as the update is available

updating your software as soon as the update is available

Get more tips to protect yourself and your devices at GetCyberSafe.ca

- i

Get Cyber Safe Awareness Tracking Survey, EKOS, 2020